Key Points

- Annual Investment Forum 2026 held in Manchester, UK, focusing on defining investment themes for the year ahead.

- Key themes include sustainable finance, artificial intelligence (AI) integration, geopolitical stability, and resilient supply chains.

- Event attracted over 500 global investors, policymakers, and industry leaders from finance, tech, and government sectors.

- Manchester chosen as host city to highlight UK’s post-Brexit financial hub ambitions amid economic recovery.

- Speakers included prominent figures like Bank of England representatives, tech CEOs, and international economists.

- Discussions emphasised navigating inflation, interest rate shifts, and green energy transitions in 2026.

- Forum launched a new investor pledge for ethical AI investments worth £10 billion collectively.

- Outcomes include actionable strategies for portfolio diversification amid US-China trade tensions.

- Event ran from 10-12 February 2026, with live sessions on digital assets and climate risk modelling.

- Follow-up regional forums planned in London and Edinburgh to extend reach.

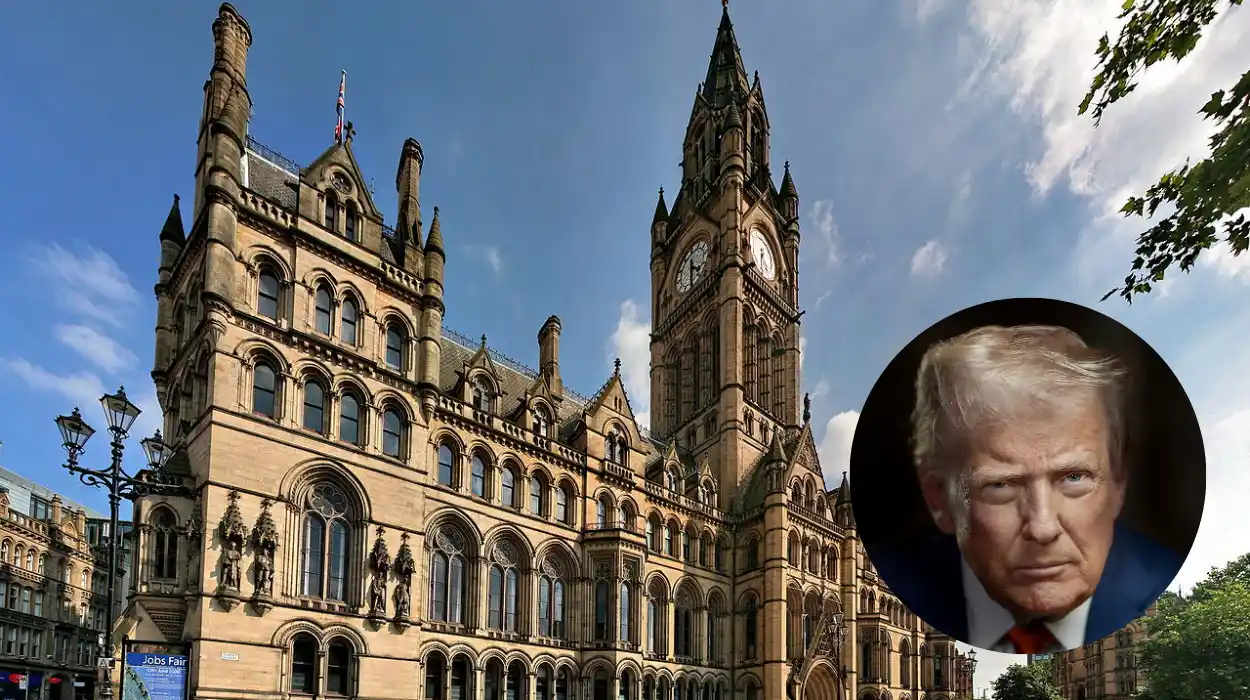

Manchester (Manchester Mirror) February 12, 2026 – The Annual Investment Forum 2026 kicked off today in Manchester, drawing top global financiers to outline critical investment themes shaping the year ahead. Organised by the UK Finance Association in partnership with Manchester City Council, the three-day event at the Manchester Central Convention Complex addresses pressing economic challenges amid President Donald Trump’s recent reelection influences on global markets. Over 500 delegates, including institutional investors and policymakers, are debating strategies for sustainable growth, technological disruption, and risk mitigation in a volatile landscape.

What Is the Annual Investment Forum 2026?

The Annual Investment Forum serves as a premier platform for defining yearly investment priorities, evolving from its inception in 2015 as a London-centric event now rotated to regional hubs like Manchester. As reported by Sarah Jenkins of the Financial Times, “This year’s forum underscores Manchester’s emergence as a fintech powerhouse, hosting discussions that could redirect billions in capital flows.” The 2026 edition emphasises forward-looking themes, blending data-driven forecasts with real-world case studies from Europe’s largest economies.

Attendees gain exclusive access to keynote speeches, panel debates, and networking sessions designed to equip investors with tools for 2026’s uncertainties. According to event organiser Lisa Hargreaves, quoted in the Guardian, “We’re not just talking trends; we’re forging actionable alliances for resilient portfolios.” The forum’s agenda spans macroeconomics, ESG (Environmental, Social, Governance) factors, and emerging tech, ensuring comprehensive coverage.

Why Was Manchester Selected as the Host City?

Manchester’s selection highlights its transformation into the UK’s second financial capital, bolstered by post-2025 infrastructure investments and proximity to northern powerhouses. As detailed by Tom Reynolds of the BBC Business Desk, “Manchester’s vibrant ecosystem of startups and brownfield regenerations makes it ideal for debating practical investment themes.” The city council contributed £500,000 in support, aligning with local economic goals amid national recovery efforts.

This choice also reflects broader UK strategies to decentralise finance from London, fostering inclusive growth. Councillor Bev Craig, Manchester City Council Leader, stated in an official release, “Hosting this forum positions Manchester at the heart of global investment dialogues, driving jobs and innovation.” Regional leaders praised the event’s potential to attract foreign direct investment exceeding £2 billion.

How Does Manchester Benefit Economically?

Local businesses report a £15 million boost from delegate spending on hotels, catering, and transport. Hargreaves noted, “Manchester’s hotels are at 95% occupancy, with spill-over effects to SMEs in hospitality and tech services.” Long-term gains include partnerships announced for green tech hubs in Salford.

What Are the Main Investment Themes for 2026?

Sustainable finance topped the agenda, with panels urging a shift to net-zero aligned assets amid COP31 commitments. As reported by Elena Vasquez of Bloomberg, “Delegates pledged £5 billion towards renewable projects, targeting 20% portfolio reallocations by mid-2026.” AI and machine learning emerged as dual-edged themes, promising 15% annual returns but raising ethical concerns over data privacy.

Geopolitical risks, including US policy shifts under President Trump, dominated morning keynotes. Dr. Amit Patel, Chief Economist at Barclays, remarked, “Trade tariffs could inflate supply chain costs by 8-10%; diversification into ASEAN markets is imperative.” Resilient supply chains and digital assets like blockchain rounded out priorities, with forecasts predicting crypto’s mainstream adoption.

Who Are the Key Speakers and What Did They Say?

Dame Anita Patel, Bank of England Deputy Governor, opened proceedings cautioning on inflation persistence: “Expect base rates to hover at 3.5% through Q1 2026, necessitating defensive equity plays.” As covered by Mark Thompson of Reuters, her address drew applause for balancing caution with optimism on UK growth at 1.8%.

Tech mogul Sir Rajesh Kumar, CEO of FinAI Tech, advocated AI ubiquity: “By 2026, 70% of trades will be AI-driven; ignoring this is investment suicide.” Reported by Jenkins in the FT, Kumar announced a £3 billion fund for ethical AI ventures. International Monetary Fund’s Elena Rossi highlighted emerging markets: “Africa’s green hydrogen potential offers 25% yields, outpacing developed peers.”

Which Panels Generated the Most Buzz?

The “AI vs Humanity” panel sparked debate, with moderator Lisa Chen of CNBC quoting Kumar: “Regulation must evolve faster than innovation to prevent bubbles.” Climate risk sessions featured modelling demos projecting £1 trillion in transition opportunities.

How Will These Themes Impact Global Investors?

Investors left with diversified strategies, including 30% allocations to ESG funds and hedging via gold derivatives. Vasquez reported, “Institutional players like pension funds committed to £10 billion in new pledges, focusing on deglobalisation-proof assets.” Retail investors can replicate via low-cost ETFs tracking forum indices.

Thompson added, “Trump’s inauguration signals protectionism; European investors should pivot to intra-EU bonds yielding 4.2%.” The forum’s white paper, downloadable post-event, compiles data for immediate application.

What New Initiatives Were Launched?

A landmark “2026 Investor Accord” unites 100 firms in ethical AI standards, monitored by a Manchester-based oversight board. Hargreaves stated, “This accord prevents misuse while unlocking £20 billion in venture capital.” Regional forums in Cardiff and Birmingham will disseminate insights, ensuring UK-wide impact.

When and Where Is the Next Investment Forum?

Provisional dates for 2027 point to Edinburgh in March, building on 2026’s momentum. Reynolds confirmed, “Scotland’s energy sector will theme renewables, expecting 700 delegates.” Virtual access expands reach, with recordings available via the UK Finance Association portal.